Friday, June 01, 2012

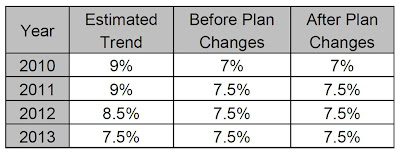

Price Water House Coopers (PwC) reports that for the fourth year in a row the annual US health care rate is expected to trend lower. Since 2010, PwC’s Health Research Institute national survey of employers has indicated another year of relatively flat trend in health care plan costs.

Medical trend is significant since it makes up the most important factor in determine employer and employee health insurance premiums for the coming year. In addition, medical trend can be broken down into its constituent components allowing employers and policy makers to determine which aspects of health care are moving faster or slower. PwC attribute the slow-down in medical trend to:

• Medical supply and equipment costs

• New forms of primary care delivery

• Price transparency

• Generic drugs

• Economic correlation

PwC believes the decrease in medical supply and equipment costs are related to an increase in the employment of physicians by hospitals, on-going consolidation of hospital systems, and governmental trenchancy rules. The result is that hospitals have been able to leverage their increased purchasing power to drive down costs, while governmental transparency rules have made physician honorariums more visible.

As deductibles for traditional and high deductible health care plans have increased, members have chosen alternative forms of primary care delivery. Care delivered in on-site and retail walk-in clinics are significantly less expensive than physician offices.

With the up-take in high deductible health care plans, price transparency has taken on added importance. Currently, over 75% of states have some form of health care price disclosure laws in place. Increasingly, organizations such as Health Advocate, Change Health Care, Castlight, and others are providing members with pre-procedure price information allowing members to informed decisions.

One area of high visibility is that of pharmaceutical costs. In the last several years and projected for the next several years the conversion of numerous brand name drug to generic equivalents is expected to have a significant cost impact. PwC expects the sales of brand name drugs to fall by over 30% between 2011 and 2014.

While not commonly considered discretionary spending, health care consumption does correlate closely to the overall state of the economy. The lingeringly and slow recovery has had a suppressive impact on some medical procedures, including preventative screenings.

While a medical trend rate of 7.5% is still several multiples of general inflation, compared to 9, 10, 11 or 12 percent, it does represent an improvement. However, even at 7.5%, health costs can be expected to double in just under 10 years. Which means that both employers and employees can see significant increases to come.

No comments:

Post a Comment